Buying an RV is an important if not daunting financial decision. It’s a significant purchase in price alone. And then you have to consider the lifestyle costs that include everything from fuel to RV-specific insurance to maintenance to off-season storage. The key to a financially successful RV lifestyle is an in-depth knowledge of what things cost, what you can afford, and what steps you can take to budget. And that’s especially true when it comes to financing the purchase of an RV — the most significant cost of the lifestyle.

The experience of buying an RV falls somewhere between buying an automobile and buying a house (appropriately). It’s a significant investment because of the sheer dollar amount and because of its long-term value. What you pay now will be relevant in ten or twenty years when you are either still paying off a loan, selling the RV, or trading it in. But pay the wrong price or get the wrong financing term and it could affect you later.

You can secure good financing terms now that will be of considerable benefit further down the road. There are things you can control to impact your terms. Here, we’ll cover factors like down payment amount, credit score, loan type, and financing options — all of which play an important role in determining what you will pay overall for the RV portion of the RV lifestyle.

Daunting? Nah. Empowering. The more you know, the better equipped you’ll be at the dealership to find the RV that makes the most sense with your budget and to secure terms you understand and are capable of maintaining.

Evaluate your budget and credit score

Courtesy of Camping World

So what’s in the cookie jar? The two most common roadblocks that occur when financing an RV are overestimating your financial capability and underestimating it. We simplify the process too much: can I make that monthly payment? Sure. Or, conversely: Can I afford a $35,000 trailer? Heck no.

Yes, monthly payment and overall cost are two of the most significant factors. But there’s also a down payment, term length, and interest rates. Collateral and value depreciation. Each of these will come into play and will change your outlook. For now, an honest evaluation of your budget will prioritize your financial health first, and owning an RV second.

By taking a look at your finances, you should be able to determine the two most important pieces of information you’ll need to finance your RV:

- how much you can afford to put into a down payment

- how much you can afford to pay each month on your loan

Get specific. We recommend making use of apps that can help you identify what you spend and what you save, month to month. Empower Personal Wealth and Goodbudget track what you spend and what you can spend to help you determine your monthly allowance to put towards something like an RV.

It can be especially tricky to determine the down payment amount you put down. Financial advisors recommend we set aside and keep about six months’ worth of safety spending in the bank in the case of an emergency. Common sense tells us we should set aside more. And somewhere in there is the downpayment amount we feel comfortable putting towards an RV purchase.

Lenders use your credit score as a primary factor in determining your eligibility and creditworthiness, which will determine your interest rate and loan approval. You can use apps like Credit Karma to check your credit score (without penalty), and it will also provide updates to changes in your credit score.

What determines your credit score? Here’s a simple breakdown of the factors and their weight on your credit score.

- Payment history (35%) – What has been your track record of paying your bills on time?

- Outstanding debt (35%) – An overview of what you owe towards other loans or penalties.

- Length of credit history (15%) – Your experience as a borrower (how long and how reliable).

- New credit (15%) – How much have you recently opened in new credit lines?

These factors will each contribute to your overall credit score, which is a system that ranks you between 300 and 850 points, which is a measure of your creditworthiness. Banks want to know they can trust you to make good on your loan, and this is the system they use. Below is a breakdown of credit score rankings.

- Exceptional: 800 to 850

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Very Poor: 300 to 579

Most RV lenders favor a score that is at or above 700. But if you are lower than this, don’t count yourself out. Some lenders will approve a score as low as 650, but at a higher interest rate. And this is the catch: Your loan approval doesn’t necessarily ensure your loan quality. You might get approved for a loan, but at what cost? A high-interest rate, more of a down payment required, for a longer term, and, inevitably, a higher overall cost.

The more of a risk you are to a lender, the more requirements they’ll have.

The risk to the lender will determine your loan terms

Before we talk about the different types of loans and financing available, it’s helpful to understand the reason why some lenders will require higher interest rates, different loan terms, or different forms of collateral.

The golden rule of lending: The lender wants to enter loans with confidence that the lendee will pay back the loan. Otherwise, the lender is at risk. So as you learn about the financing process for RVs, always fall back on the fact that lenders want security in their loans. This manifests in a couple of different ways:

Interest rate

The less likely a bank believes you are to pay off your loan in full, the higher it will make your interest rate. That way, the bank quickly starts to earn back the loan. If your credit score is low, the bank might see this as an increased risk and will increase your interest rate.

Term length

The longer the amount of time you require to pay off the loan, the longer the bank is at risk. Plus, the bank may think you are less capable of paying off your loan if you need a longer term length.

Debt to income ratio

This is your monthly debt payments divided by your gross monthly income. The more you stretch your borrowing capacity, the more suspicious a potential lender may be. If considering an RV, take stock of your DTI and consider paying off a significant loan prior to applying.

Down payment

The bigger your down payment, the less risk to the lender. Common sense tells the lender that if you can accumulate a significant down payment (and borrow less), the more likely you are to pay off your full loan.

Collateral

Many loans require some form of collateral or a form of extra security. Requiring a cosigner is a good example of additional security, and this provides extra assurance to the lender that they will recoup their loan amount.

For secured loans (more on these later), the RV itself is the collateral, meaning the lender can repossess the loan if you are unable to make payments. We mention this because lenders typically want to enter a loan where the value of the RV holds. This is why it is sometimes easier to gain approval for a loan for a new or newer model when financing an RV.

These are the primary factors that determine the risk to the lender and therefore determine your loan terms. When thinking about the loan relationship, consider these two main categories: the risk to the lender and your creditworthiness.

Types of RV Loans

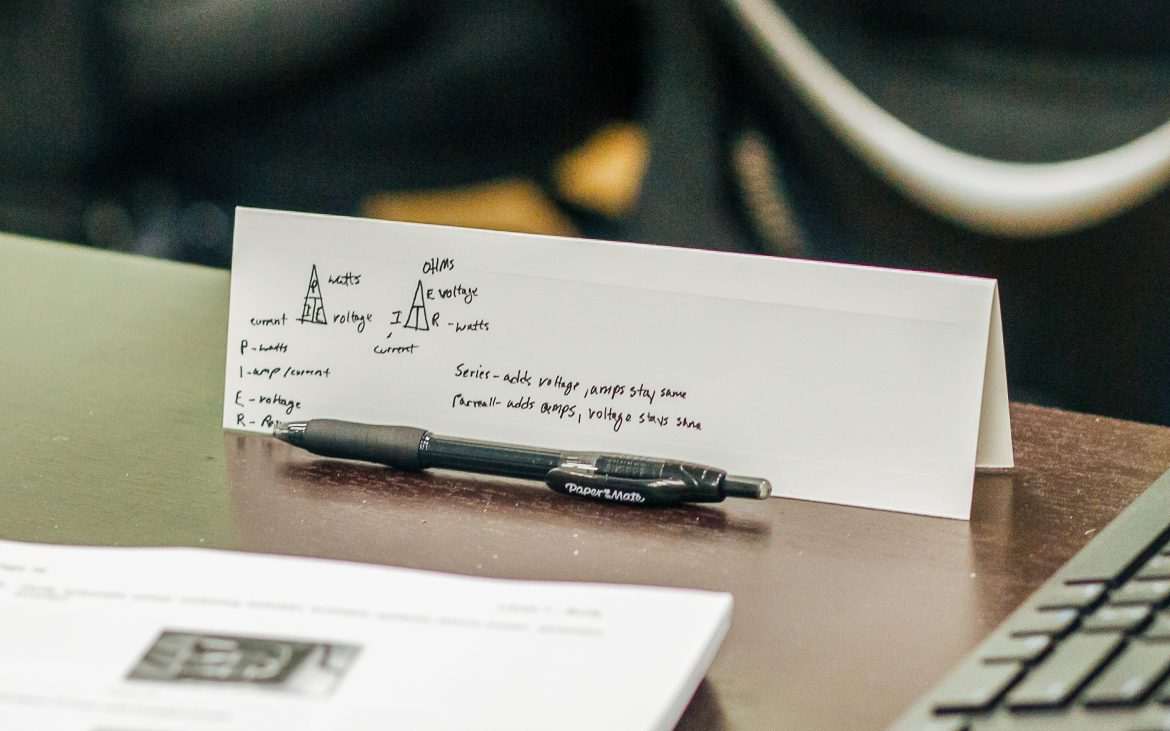

Courtesy of Camping World

Not all RV loans are the same. In fact, there are three primary loan types: secured, unsecured, and peer-to-peer. (Recently, a fourth loan category has become available for peer-to-peer fleet owners who run rental businesses, but we won’t cover that here).

These different types of loans still fall back on those same factors fundamental to a lender/lendee relationship: risk and creditworthiness. But they operate in different arrangements regarding interest rate, term length, collateral, and eligibility.

Secured loan

A secured loan means that the loan amount is backed up — or “secured” — with some form of collateral. RVs are a big investment. For secured RV loans, the RV itself acts as the collateral on the loan. This alleviates risk to the lender because, should you stop paying, they can repossess the RV and recoup their risked value.

Secured loans often apply to RVs less than fifteen years old. (When the RV is the collateral, it needs to have foreseeable resale value).

Secured loans typically require a larger down payment, too. This serves as additional security for a larger loan. After all, a lot as at stake for the lender with an RV of significant value. The upside, though, is that, with a larger down payment and with the RV serving as collateral, you can expect a competitive interest rate on your low, even for a longer term.

Unsecured loan

Unsecured loans require no collateral. They act as personal loans and can be used when financing an RV. So what’s the catch? Well, unsecured loans have some important distinctions from secured loans. Most importantly, unsecured loans are usually lower in dollar amount than secured loans. Buyers typically use an unsecured loan for used RVs, low-cost RVs, high-mileage RVs, or as a loan flexible enough to be used to pay for auxiliary RV-related expenses.

Because unsecured loans are technically riskier for lenders, they can require a higher interest rate, more of a down payment, and they’re pickier about who they lend to. For unsecured loans, you need to have a good credit score and a low debt-to-income ratio to qualify.

Keep in mind that point about the interest rate. And remember that qualifying for a loan does not mean the loan is a healthy financial decision. Unsecured loans can go as high as 36% interest rate, and, at that point, it’s not likely to be a smart investment.

Peer-to-peer loans

Next up are peer-to-peer loans. So, secured loans and unsecured loans require you to work with a lender to reduce their risk enough that they are willing to approve you for a loan. With these loan types, it can be hard to qualify with poor credit or a minimal down payment. Lenders in these traditional loans are often banks, dealerships, or credit unions — and they each have fairly strict policies on how far they can bend the yardstick to make a loan.

But what if you found a private lender willing to take a gamble with more risk? Enter the peer-to-peer loan.

Peer-to-peer loans are fairly new. They allow two individuals to circumvent the traditional bank or credit union model and lend directly through the use of an online lending platform. In these situations, they can reach an agreement on any terms they like, which sometimes allows for borrowers to qualify when banks or credit unions had rejected them.

The drawbacks? There’s more risk to the borrower and the lender. For the borrower, there is less protection for them if they fail to make a payment, and their debt can quickly be passed on to a collections agency. They may also see higher fees through the platform.

For the lender, you are sometimes dealing with a borrower who is unable to secure lending from a bank or credit union — and there’s typically a good reason for that.

RV type

Generally, smaller RVs like campers, travel trailers, and pop-ups will use an unsecured loan because they are lower in value. The same is true with used RVs. You may incur a higher interest rate for older and smaller RV loans, which makes it important to front as much as possible on the down payment.

Secured loans typically apply to RV models of 15 or fewer years and under 100,000 miles.

Also, if you are considering purchasing several RVs to use for commercial use — such as running an RV rental company — new and upcoming loans will make it easier for these borrowers to get approval for higher dollar, secured loans.

Alternate financing

You may also want to consider additional financing options. Typically, you would orchestrate your loan through a traditional lender like a bank or a credit union. In those cases, you may be able to prequalify for a loan, and we will cover pre-approval later in this article. But dealership financing is also a route you can take, but consider some of the factors involved.

Many dealerships offer financing options, and these may seem especially convenient to complete all paperwork through one organization, from start to finish. But know that convenience will often come at the price of a higher interest rate and potential associated fees. Prepare to have a response for such incentives as extended warranties, cash back, or discounts.

As we mentioned earlier, an RV loan falls somewhere between an auto loan and a mortgage. So it makes a bit of sense that some RV buyers choose to use their home equity to finance an RV. These actually may have a lower interest rate, but it’s always an added risk to use your home in a purchase agreement, and you effectively put your home at risk when using it as collateral.

What’s an RV worth?

We’ve provided a lot of information about qualifying for an RV loan. The first step, determine your budget. The second step, get qualified. But we’ve yet to discuss how much of a loan you should take out for a given RV. And that decision needs to go beyond what’s attractive and what you can afford.

How do you know you’re paying the right amount for an RV? Without a clear understanding of how pricing works, you could be at risk and at the mercy of what a dealership tells you.

Consider the industry when financing an RV. As with automobiles, the RV industry operates much, if not more, based on supply and demand. For example, 2021 saw a skyrocket in RV sales across the country as more new campers took to the outdoors in the face of a pandemic. RV prices increased. It became more difficult to find an RV. Prices have since balanced, but it was a manifest example of that supply and demand relationship when it came to RVs.

Prior to purchasing an RV, make sure you’ve researched the model, industry trends, manufacturer, and dealer. Each of these might affect the current rate of the RV. A higher price might not be a mistake if the demand for a certain type of RV or model is high, for example.

Buying used

The used market is an increasingly major player in the RV industry — especially after so many new RVers came into the market during the pandemic. Don’t rule out purchasing a used RV if you are in the market. In fact, you may be able to afford a larger or more robust RV if you buy used. The key is to determine the accurate value of the RV.

When shopping used, know that this may change the financing process, and you may even have to resort to an unsecured loan with a higher interest rate or even find a peer-to-peer rate on an online platform. To protect yourself further from possible overpricing, use tools like the Good Sam RV Valuator to determine the correct value of an RV.

Also, research the RV’s history before purchasing, including any accidents or major repairs. Use resources like Carfax or the National Motor Vehicle Title Information System to find any possible incidents that may affect the price of the RV. Also, determine from the seller if the RV comes with any extended warranties, extended service plans, or notable accessory values.

Nuts and bolts

Courtesy of Camping World

So what steps are involved when you’re ready to finance an RV? Here we break down the nuts and bolts required to finance an RV.

Get pre-approval for a loan (optional)

Loan pre-approval helps you budget and determine the details of your loan before you ever choose an RV to finance. This is especially helpful, walking into the dealership with a set amount you are approved for. This reduces the risk of making poor financing decisions based on a specific RV or dealership offer.

Negotiate the RV price

If you’ve done your research, you should have a good understanding of what the type of RV — including make, model, year — should run. Obviously, you will still need to negotiate a price with the seller or dealer, but having a ballpark figure can go a long way. And, as always, be ready to walk away from the deal if it’s not within your pre-approval or your pre-determined budget.

Determine down payment, term length

If you’ve taken stock of your finances and your budget, you should already have a down payment in mind when it comes to financing a specific RV. The only thing that may affect that amount will be the term length and offered interest rate.

Review loan agreement, follow-through

If you’re unsure about any terms, fees, rates, or monthly expectations, now is the time to take the time before signing any paperwork to know for certain the agreement you’re settling on. You should have a crystal clear understanding of what the total cost will be, including your monthly payments, interest rate, additional fees, and the total cost over the term of the loan, which could stretch as far as thirty years.

Financing an RV is not out of anyone’s wheelhouse, they just need to be prepared to have the patience and commitment to understanding the steps involved, the potential risk, and the expectations. To learn more about financing an RV, the Good Sam Finance Center is your resource when considering financing an RV. With such tools as the RV loan calculator and a comprehensive FAQ section that answers borrowers’ most important questions, you get the knowledge you need to make the most responsible, cost-effective decisions when it comes to financing your RV.

Carl Corder

Wow! Those things are pretty incredible. The Good Sam RV Valuator only goes back as far as 1957. I’m curious, too!

Michael Shoen

Need to find someone who can appraise my vintage 1934 Bowlus Road Chief travel trailer. Any ideas?? Thank you.